All Categories

Featured

Table of Contents

The are entire life insurance coverage and global life insurance. The cash money value is not included to the death benefit.

The plan finance rate of interest rate is 6%. Going this route, the interest he pays goes back right into his plan's cash value instead of an economic organization.

Infinite Banking Institute

The idea of Infinite Banking was created by Nelson Nash in the 1980s. Nash was a money professional and follower of the Austrian school of business economics, which supports that the value of items aren't explicitly the outcome of traditional economic structures like supply and need. Instead, people value cash and products in different ways based upon their financial condition and needs.

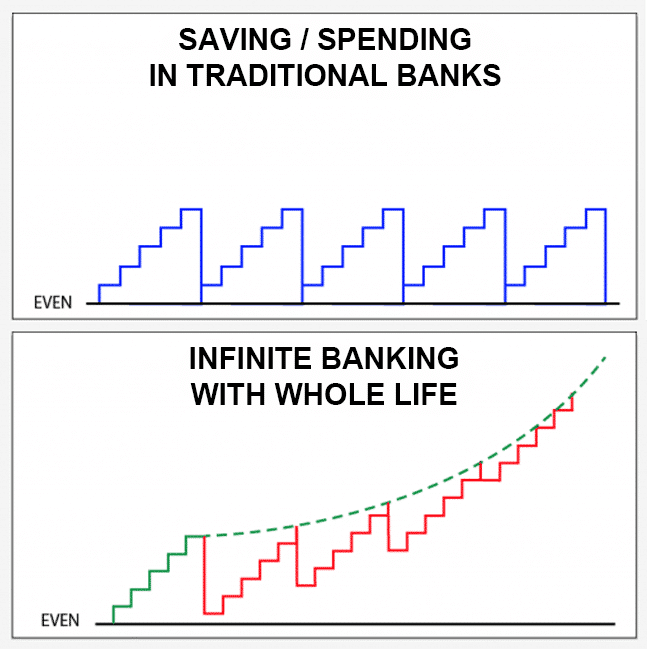

One of the pitfalls of traditional financial, according to Nash, was high-interest prices on fundings. Long as financial institutions established the rate of interest rates and financing terms, people really did not have control over their very own wealth.

Infinite Banking needs you to possess your economic future. For goal-oriented individuals, it can be the ideal financial device ever before. Right here are the benefits of Infinite Financial: Arguably the single most helpful facet of Infinite Banking is that it enhances your capital. You don't need to undergo the hoops of a standard financial institution to obtain a financing; merely request a plan financing from your life insurance business and funds will be provided to you.

Dividend-paying entire life insurance policy is really low threat and uses you, the policyholder, a lot of control. The control that Infinite Financial offers can best be grouped right into 2 categories: tax benefits and possession securities - concept bank. Among the factors whole life insurance policy is excellent for Infinite Banking is how it's taxed.

Infinite Banking Vs Bank On Yourself

When you use entire life insurance for Infinite Banking, you enter into a personal agreement between you and your insurance policy business. These securities may vary from state to state, they can consist of security from asset searches and seizures, security from judgements and protection from lenders.

Entire life insurance policy plans are non-correlated possessions. This is why they work so well as the economic foundation of Infinite Banking. No matter of what happens in the market (supply, genuine estate, or otherwise), your insurance coverage plan maintains its worth.

Market-based financial investments grow wealth much faster but are revealed to market variations, making them naturally risky. What if there were a 3rd container that supplied safety but additionally modest, surefire returns? Entire life insurance policy is that third bucket. Not just is the price of return on your entire life insurance policy assured, your survivor benefit and premiums are also ensured.

Right here are its main benefits: Liquidity and access: Plan lendings supply prompt accessibility to funds without the limitations of standard financial institution finances. Tax effectiveness: The cash money worth grows tax-deferred, and plan financings are tax-free, making it a tax-efficient device for building riches.

Infinite The Chaser Live Music Bank

Property security: In numerous states, the money worth of life insurance policy is secured from financial institutions, adding an added layer of monetary security. While Infinite Financial has its merits, it isn't a one-size-fits-all service, and it includes substantial downsides. Right here's why it may not be the most effective technique: Infinite Banking commonly calls for elaborate plan structuring, which can puzzle insurance holders.

Think of never ever needing to bother with small business loan or high rate of interest once more. Suppose you could borrow money on your terms and construct riches at the same time? That's the power of infinite financial life insurance. By leveraging the money value of whole life insurance policy IUL plans, you can expand your riches and borrow cash without relying upon standard banks.

There's no collection car loan term, and you have the freedom to select the payment routine, which can be as leisurely as paying off the loan at the time of fatality. This versatility reaches the servicing of the finances, where you can choose interest-only payments, keeping the funding balance flat and convenient.

Holding cash in an IUL fixed account being attributed passion can usually be far better than holding the cash on deposit at a bank.: You have actually constantly dreamed of opening your own bakery. You can borrow from your IUL policy to cover the preliminary costs of renting an area, acquiring equipment, and working with team.

Using A Life Insurance Policy As A Bank

Personal loans can be gotten from typical financial institutions and lending institution. Right here are some bottom lines to think about. Charge card can give a flexible means to borrow money for extremely short-term durations. However, borrowing cash on a bank card is usually extremely pricey with yearly percent prices of interest (APR) often reaching 20% to 30% or even more a year.

The tax therapy of plan car loans can vary considerably relying on your nation of home and the particular terms of your IUL policy. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, plan finances are typically tax-free, supplying a considerable advantage. However, in various other jurisdictions, there may be tax ramifications to think about, such as potential taxes on the car loan.

Term life insurance coverage only provides a death benefit, without any type of cash value accumulation. This implies there's no cash value to obtain against.

Nevertheless, for funding policemans, the extensive policies enforced by the CFPB can be viewed as difficult and limiting. Lending police officers frequently say that the CFPB's guidelines develop unneeded red tape, leading to even more documentation and slower funding processing. Guidelines like the TILA-RESPA Integrated Disclosure (TRID) guideline and the Ability-to-Repay (ATR) demands, while focused on securing consumers, can result in hold-ups in closing bargains and increased functional costs.

Table of Contents

Latest Posts

Visa Infinite Alliance Bank

Life Insurance Bank

Banking With Life

More

Latest Posts

Visa Infinite Alliance Bank

Life Insurance Bank

Banking With Life