All Categories

Featured

Table of Contents

For the majority of people, the greatest problem with the unlimited banking idea is that preliminary hit to very early liquidity brought on by the costs. This con of boundless financial can be lessened substantially with appropriate plan design, the initial years will certainly always be the worst years with any Whole Life policy.

That said, there are particular unlimited banking life insurance policy policies made mainly for high very early cash worth (HECV) of over 90% in the first year. The long-term performance will certainly typically significantly delay the best-performing Infinite Banking life insurance policies. Having accessibility to that extra 4 numbers in the initial couple of years may come at the price of 6-figures in the future.

You actually obtain some substantial lasting benefits that aid you recover these early costs and then some. We locate that this hindered very early liquidity trouble with limitless financial is extra mental than anything else as soon as extensively checked out. As a matter of fact, if they absolutely required every dime of the cash missing from their boundless banking life insurance policy policy in the very first couple of years.

Tag: boundless financial principle In this episode, I speak concerning financial resources with Mary Jo Irmen who instructs the Infinite Banking Idea. With the rise of TikTok as an information-sharing system, economic advice and approaches have found a novel method of spreading. One such method that has been making the rounds is the boundless financial concept, or IBC for short, garnering recommendations from celebs like rap artist Waka Flocka Flame.

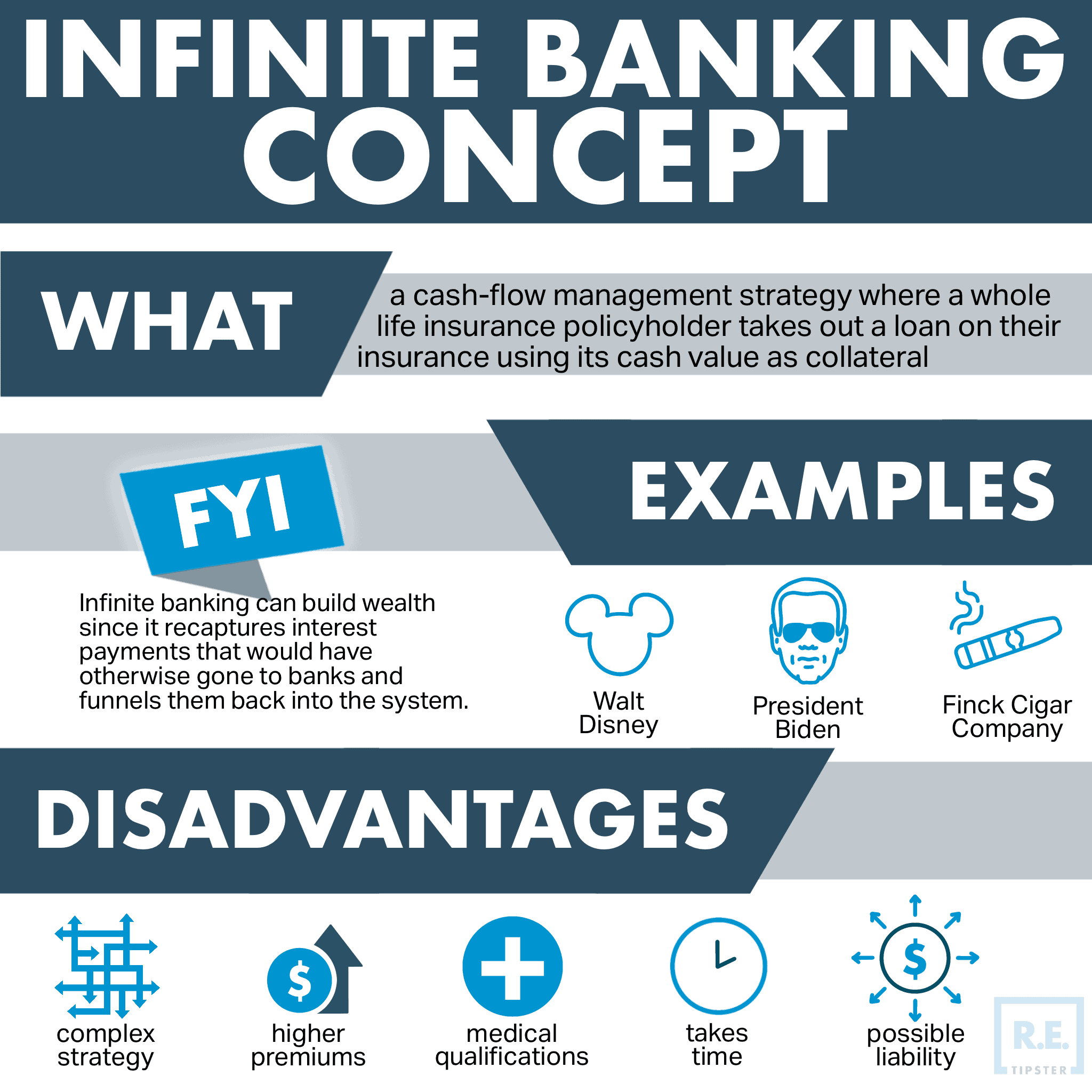

Within these policies, the cash money value expands based on a rate established by the insurance company. Once a substantial money value builds up, insurance policy holders can get a cash worth car loan. These lendings differ from standard ones, with life insurance policy functioning as security, implying one might lose their insurance coverage if borrowing exceedingly without appropriate cash money value to sustain the insurance coverage prices.

And while the appeal of these plans appears, there are natural restrictions and risks, requiring diligent money worth tracking. The method's legitimacy isn't black and white. For high-net-worth individuals or company owner, particularly those using strategies like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and compound growth can be appealing.

Be Your Own Banker Whole Life Insurance

The attraction of infinite banking doesn't negate its obstacles: Expense: The fundamental need, an irreversible life insurance policy plan, is pricier than its term counterparts. Eligibility: Not everybody qualifies for entire life insurance coverage due to strenuous underwriting processes that can omit those with particular wellness or lifestyle problems. Intricacy and threat: The detailed nature of IBC, coupled with its risks, might prevent several, particularly when simpler and less dangerous choices are available.

Allocating around 10% of your monthly income to the plan is just not viable for most individuals. Component of what you review below is simply a reiteration of what has currently been stated over.

Prior to you get yourself right into a situation you're not prepared for, recognize the adhering to initially: Although the principle is frequently offered as such, you're not actually taking a financing from on your own. If that were the situation, you wouldn't have to repay it. Rather, you're borrowing from the insurance business and need to settle it with rate of interest.

Some social media posts recommend using cash money value from whole life insurance to pay down credit card debt. When you pay back the finance, a part of that passion goes to the insurance business.

For the first a number of years, you'll be paying off the payment. This makes it very challenging for your policy to gather value throughout this time around. Whole life insurance policy prices 5 to 15 times much more than term insurance coverage. Most individuals just can't manage it. So, unless you can manage to pay a few to several hundred bucks for the next years or even more, IBC won't benefit you.

Life Rich Banking

If you need life insurance coverage, here are some beneficial suggestions to take into consideration: Take into consideration term life insurance coverage. Make sure to go shopping about for the finest price.

Copyright (c) 2023, Intercom, Inc. () with Reserved Font Call "Montserrat". This Typeface Software is licensed under the SIL Open Up Font Certificate, Variation 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Reserved Font Style Call "Montserrat". This Typeface Software program is accredited under the SIL Open Up Font Permit, Version 1.1.Avoid to primary content

Chris Naugle Infinite Banking

As a CPA focusing on real estate investing, I have actually brushed shoulders with the "Infinite Banking Idea" (IBC) extra times than I can count. I've even talked to experts on the topic. The main draw, other than the evident life insurance advantages, was constantly the idea of accumulating cash money worth within a permanent life insurance policy plan and borrowing against it.

Certain, that makes good sense. However honestly, I always believed that cash would certainly be better invested directly on investments rather than funneling it via a life insurance plan Till I discovered how IBC could be combined with an Irrevocable Life Insurance Policy Count On (ILIT) to create generational wide range. Let's begin with the fundamentals.

Scb Priority Banking Visa Infinite

When you obtain versus your policy's cash value, there's no collection payment timetable, offering you the freedom to manage the car loan on your terms. Meanwhile, the cash money worth proceeds to expand based on the policy's warranties and returns. This setup permits you to access liquidity without interfering with the long-lasting development of your plan, gave that the car loan and passion are managed intelligently.

As grandchildren are birthed and expand up, the ILIT can purchase life insurance coverage policies on their lives. Family members can take finances from the ILIT, using the cash value of the plans to fund financial investments, begin organizations, or cover major costs.

An essential facet of handling this Family Bank is making use of the HEMS criterion, which stands for "Wellness, Education And Learning, Upkeep, or Support." This standard is typically included in trust fund contracts to direct the trustee on just how they can disperse funds to beneficiaries. By adhering to the HEMS requirement, the trust makes certain that circulations are created necessary needs and lasting support, protecting the trust's properties while still offering relative.

Boosted Flexibility: Unlike stiff financial institution loans, you regulate the repayment terms when borrowing from your own plan. This allows you to structure payments in such a way that straightens with your service cash flow. infinitive power bank 2000mah. Better Capital: By financing service expenditures via policy finances, you can possibly release up money that would certainly otherwise be linked up in standard car loan settlements or equipment leases

He has the exact same devices, yet has additionally built extra cash value in his policy and received tax advantages. Plus, he now has $50,000 available in his plan to make use of for future chances or costs., it's crucial to view it as more than just life insurance coverage.

Ibc Banking Concept

It has to do with developing a versatile financing system that provides you control and offers several benefits. When utilized tactically, it can complement various other financial investments and organization strategies. If you're fascinated by the potential of the Infinite Financial Principle for your company, below are some actions to think about: Enlighten Yourself: Dive deeper right into the concept with respectable publications, workshops, or consultations with experienced experts.

Table of Contents

Latest Posts

Visa Infinite Alliance Bank

Life Insurance Bank

Banking With Life

More

Latest Posts

Visa Infinite Alliance Bank

Life Insurance Bank

Banking With Life