All Categories

Featured

Table of Contents

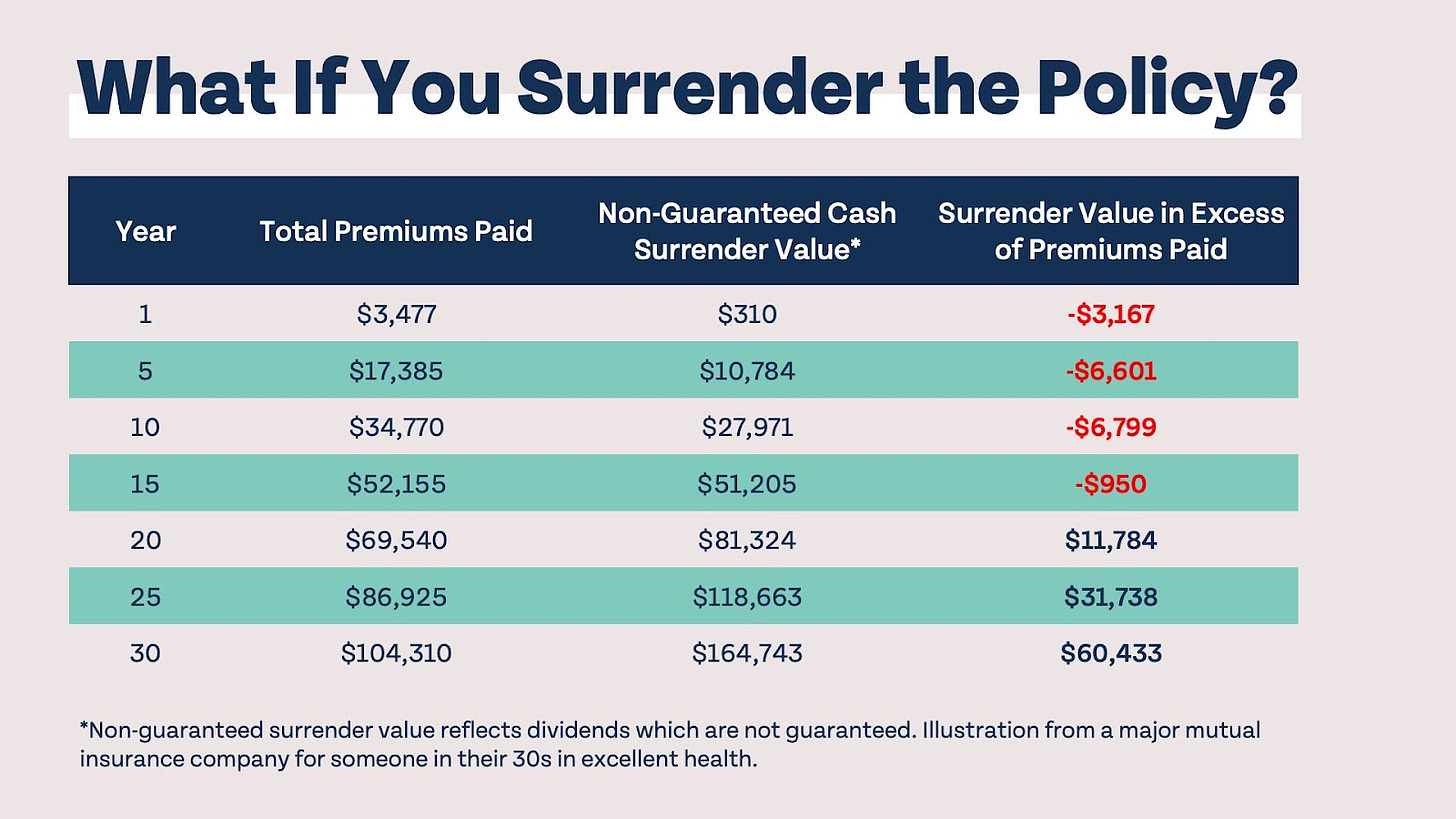

For the majority of people, the largest trouble with the unlimited banking concept is that first hit to very early liquidity brought on by the expenses. Although this disadvantage of boundless banking can be minimized significantly with appropriate plan layout, the first years will always be the most awful years with any type of Whole Life plan.

That stated, there are certain limitless banking life insurance policies designed largely for high very early cash worth (HECV) of over 90% in the very first year. The long-lasting performance will frequently substantially lag the best-performing Infinite Financial life insurance coverage policies. Having accessibility to that additional 4 figures in the first few years might come with the price of 6-figures in the future.

You actually get some substantial lasting benefits that aid you recoup these early costs and afterwards some. We discover that this prevented very early liquidity problem with limitless banking is more psychological than anything else as soon as extensively explored. If they absolutely required every dime of the money missing from their boundless financial life insurance policy in the initial couple of years.

Tag: unlimited financial principle In this episode, I speak regarding finances with Mary Jo Irmen that teaches the Infinite Financial Idea. With the rise of TikTok as an information-sharing system, economic suggestions and techniques have discovered a novel means of dispersing. One such technique that has been making the rounds is the unlimited banking concept, or IBC for short, gathering recommendations from celebrities like rapper Waka Flocka Flame.

Within these policies, the money value grows based on a rate set by the insurance firm. As soon as a substantial money worth gathers, policyholders can get a money value car loan. These finances vary from standard ones, with life insurance policy working as collateral, meaning one might lose their insurance coverage if borrowing excessively without sufficient cash money value to support the insurance policy costs.

And while the allure of these policies is apparent, there are natural limitations and dangers, requiring thorough cash money value surveillance. The technique's legitimacy isn't black and white. For high-net-worth individuals or local business owner, especially those using strategies like company-owned life insurance coverage (COLI), the advantages of tax obligation breaks and substance growth can be appealing.

Infinite H Special Girl Music Bank

The attraction of limitless banking doesn't negate its difficulties: Cost: The foundational demand, a permanent life insurance policy, is pricier than its term counterparts. Eligibility: Not everybody gets approved for whole life insurance policy due to strenuous underwriting processes that can omit those with specific wellness or way of living problems. Complexity and threat: The complex nature of IBC, coupled with its threats, may prevent numerous, especially when less complex and much less high-risk options are offered.

Allocating around 10% of your regular monthly earnings to the policy is just not feasible for many individuals. Part of what you read below is merely a reiteration of what has actually already been claimed above.

Before you get on your own into a circumstance you're not prepared for, know the complying with first: Although the idea is frequently sold as such, you're not in fact taking a car loan from yourself. If that were the instance, you wouldn't have to repay it. Instead, you're borrowing from the insurance coverage company and have to repay it with interest.

Some social media blog posts advise using cash money value from entire life insurance policy to pay down credit report card debt. The concept is that when you pay off the loan with passion, the amount will be sent out back to your investments. Unfortunately, that's not how it functions. When you pay back the finance, a part of that passion mosts likely to the insurance policy firm.

For the initial several years, you'll be paying off the compensation. This makes it exceptionally challenging for your policy to accumulate value throughout this time around. Entire life insurance costs 5 to 15 times much more than term insurance coverage. The majority of people simply can not manage it. So, unless you can manage to pay a couple of to several hundred dollars for the following years or more, IBC won't benefit you.

Infinite Banking Concept Review

Not everybody should count only on themselves for financial security. If you call for life insurance policy, here are some useful tips to take into consideration: Consider term life insurance policy. These plans supply protection during years with substantial monetary obligations, like home mortgages, student loans, or when caring for young kids. Make certain to look around for the best price.

Copyright (c) 2023, Intercom, Inc. () with Scheduled Font Style Name "Montserrat". This Font style Software program is accredited under the SIL Open Up Font Style License, Variation 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Booked Font Style Call "Montserrat". This Font style Software application is accredited under the SIL Open Up Font Style Permit, Version 1.1.Avoid to main web content

Whole Life Insurance Infinite Banking

As a CPA specializing in realty investing, I have actually cleaned shoulders with the "Infinite Financial Idea" (IBC) more times than I can count. I've even spoken with experts on the subject. The major draw, other than the evident life insurance advantages, was constantly the concept of accumulating cash worth within an irreversible life insurance policy policy and loaning versus it.

Sure, that makes good sense. Truthfully, I always assumed that cash would be better invested straight on financial investments instead than funneling it with a life insurance policy Till I uncovered just how IBC can be combined with an Irrevocable Life Insurance Trust (ILIT) to develop generational riches. Allow's begin with the fundamentals.

Infinite Banking Illustration

When you obtain against your policy's cash money worth, there's no set payment schedule, offering you the flexibility to manage the loan on your terms. The cash money value proceeds to grow based on the policy's warranties and dividends. This setup allows you to gain access to liquidity without disrupting the long-lasting development of your policy, provided that the lending and passion are managed carefully.

The process proceeds with future generations. As grandchildren are born and expand up, the ILIT can acquire life insurance coverage policies on their lives. The trust then accumulates several policies, each with growing cash worths and fatality advantages. With these plans in location, the ILIT properly becomes a "Family Financial institution." Member of the family can take fundings from the ILIT, utilizing the cash worth of the policies to fund financial investments, begin organizations, or cover major costs.

A vital facet of managing this Household Financial institution is making use of the HEMS criterion, which stands for "Health and wellness, Education, Upkeep, or Assistance." This standard is commonly consisted of in depend on agreements to direct the trustee on just how they can distribute funds to recipients. By sticking to the HEMS criterion, the depend on makes certain that circulations are made for crucial needs and long-term assistance, securing the count on's possessions while still attending to member of the family.

Boosted Adaptability: Unlike inflexible financial institution lendings, you control the payment terms when borrowing from your very own policy. This allows you to structure payments in such a way that lines up with your company cash flow. infinity life insurance company. Improved Money Flow: By financing overhead with policy fundings, you can potentially release up cash that would or else be bound in traditional finance repayments or tools leases

He has the exact same tools, but has actually also built extra money value in his policy and received tax benefits. And also, he currently has $50,000 available in his policy to utilize for future opportunities or expenditures., it's important to watch it as even more than just life insurance coverage.

Infinitive Power Bank

It has to do with developing a versatile financing system that gives you control and offers multiple benefits. When made use of strategically, it can complement other financial investments and company approaches. If you're captivated by the potential of the Infinite Financial Concept for your service, here are some steps to think about: Educate Yourself: Dive much deeper into the concept via trustworthy books, workshops, or assessments with well-informed experts.

Table of Contents

Latest Posts

Visa Infinite Alliance Bank

Life Insurance Bank

Banking With Life

More

Latest Posts

Visa Infinite Alliance Bank

Life Insurance Bank

Banking With Life